A report by the American Hospital Association estimates that a total of $323.1 billion in revenue was lost by the hospitals and healthcare systems in the United States in 2020. This statistic illustrates the breadth of the pandemic and the deleterious financial impact it has had on the U.S. healthcare system.

Although the situation seems to return to normal as they were before the pandemic, the economic impact of Covid-19 on the nation’s hospitals and healthcare systems seems to persist. This has prompted healthcare organizations around the world to look for ways to improve their financial health.

One of the most impactful ways of improving your practice’s financial standing is to ensure that you get paid for the services you provide without any delays. And one of the key ways of doing so is by tracking your practice’s days in accounts receivable and taking the necessary steps to lower them to boost your practice’s bottom line and enhance your cash flow, which is one of the best indicators of a practice’s long-term financial success.

Why manage your accounts receivable?

Accounts receivable is the money that is owed to your practice for the healthcare services that you have provided to patients. The generated invoices for the services rendered are sent out to either insurance companies or patients for payment and it is your job to keep a tab on them to make sure that you receive your payments on time. Managing your accounts receivables is at the core of any practice’s ability to operate continuously.

Mounting accounts receivable means a reduced cash flow and a higher risk of bad debts. As operating costs rocket and patients with high-deductible health plans increase, practices must monitor their accounts receivables in an attempt to collect as much of them as possible.

What are days in accounts receivable?

When looking to monitor the overall performance of your accounts receivable efforts, monitoring your days in accounts receivable can help you know where you stand financially and provide an early warning sign of a potential cash crisis.

But what are your accounts receivable days? Simply put, your accounts receivable days are the average number of days it takes to collect the payments that are owed to your practice. In other words, it’s the average number of days that an invoice will remain outstanding before it is collected. It measures how quickly your practice can convert its accounts receivable into cash.

Days in accounts receivable is an integral key performance indicator (KPI) used to gain an in-depth insight into the overall effectiveness of your practice’s credit and collection efforts. This can not only help you chart improvements in your healthcare organization’s ability to collect outstanding payments but also assess how quickly insurance companies process claims and pay the money that you are owed. Low days in the accounts receivable ratio mean that you are being paid on time and that your practice is good at collecting debts.

How to calculate accounts receivable days

To get started on calculating your accounts receivable days, you must first take a look back at your billings and calculate the average daily charges for the last several months. To calculate your average daily charges, first, add up the charges posted during a set number of months and then divide that by the total number of days in those months. Then divide the total accounts receivable by the average daily charges to get your average days in accounts receivable.

Let’s take a look at an example to see how you can calculate your accounts receivable days.

Imagine that you posted a total of $270,000 of charges in the past six months and there were 180 days in those months. Your average daily revenue is:

Average Daily Revenue = 270,000/180 = $1500

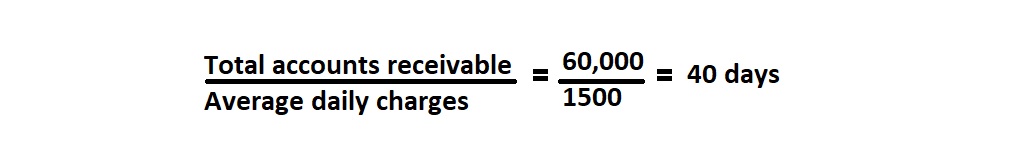

Then, if your total accounts receivable is $60,000, your days in accounts receivable will be:

Days in AR:

This means that it takes an average of 40 days for your practice to collect your payments.

Ideally, your days in accounts receivable should be under 30 to 40 days. Days in A/R within 30 days are the golden standard for all practices. If you’re averaging around 60 days or more in accounts receivable, then you must investigate immediately and find out the root cause of why this is so and then find a solution to the problem. Is there a flaw in your accounting procedures? Is a payer stalling on payments? Is there an error in your claims management process?

Benefits of tracking your accounts receivable days

Your days in accounts receivable are a vital KPI that gives you a deeper insight into your practice’s financial health. It is the simple ratio between your total accounts receivable and your average daily charges. This calculation is simple enough to crunch on any calculator, so there’s no excuse not to track this integral KPI. However, there are lots of reasons to do so.

Tracking your accounts receivable days allows you to assess the:

- Effectiveness of your collection efforts

- Timeliness of your practice’s invoicing

- The health of your cash flow

- Viability of your practice’s credit policy

But tracking your accounts receivable days alone is not enough. You must also analyze the underlying issues that are increasing your days in accounts receivable and then use this analysis to form actionable strategies to minimize this number. By doing so you can:

- Enhance your cash flow

- Minimize write-offs and subsequent bad debts

- Reduce the time for debt collection

- Implement stronger credit policies

- Lower utilization of lines of credit

Ways of lowering days in accounts receivable

Here are three of the best practices for lowering accounts receivable days at your medical practice:

Timely invoicing

A clear and swift invoicing process is crucial to making sure you receive your payments on time. Make sure to prepare and send out invoices to your patients as soon as services are rendered. Invoices not only help you in the collections process but are also useful in case of errors or any disputes that may arise. Also, make sure to follow up with your patients to ensure that they have received their invoices.

Develop a clear payment policy

A clear payment policy will allow you to be upfront with your patients so that they are aware of their financial responsibilities towards your organization beforehand. Your payment policy should be signed by the patients at the time of check-in so that they are aware of their responsibilities at the outset. It should highlight payment expectations, fee implications, collection guidelines, refund policy for overpayment, and any interest/service charges.

Efficient denial management

An effective and timely denials management process is at the crux of reducing your accounts receivable days and maximizing your revenue. Practices with an efficient denials management process are much more likely to receive payment for the services they provide on time. This is why practices must always look to manage denials properly and resubmit claims on time.

See Also: What Are The Advantages Of Medical Credentialing?

The bottom line

While every financial KPI plays an essential role in the smooth running of a healthcare facility, today’s tighter margins mean that managing your days in accounts receivable is more important now than ever before. Reducing your accounts receivable days is necessary for today’s rapidly changing financial environment to take better charge of your practice’s cash flow. Your practice should always aim to keep its days in accounts receivable less than 30 to 40 days.

By establishing a clear workflow and collections process for your staff to follow and being upfront to patients about your pricing, you have a better chance of increasing your overall revenue and thus enhancing your practice’s sustainability.

No comment yet, add your voice below!